Cryptocurrency has revolutionized the financial world, providing an alternative to traditional financial systems. While the growth of cryptocurrency has been impressive, it has also attracted fraudulent activities, cryptocurrency scams, and hacks.

This article will provide information on how to identify and avoid cryptocurrency scams to keep your investment safe.

Common Types of Cryptocurrency Scams

Some of the common types of cryptocurrency scams are;

Phishing Scams

Phishing scams involve fraudsters tricking victims into giving away sensitive information such as usernames, passwords, and private keys through fake emails or websites. Scammers use this information to gain access to victim’s cryptocurrency wallets.

Ponzi Schemes

Ponzi schemes involve fraudulent investments, where high returns are promised to investors. The returns are paid out using funds from new investors, rather than from actual investment returns. These schemes eventually collapse when the number of new investors declines.

Fake ICOs

Initial coin offerings (ICOs) are a popular way for new cryptocurrency projects to raise funds. However, some ICOs are fake, and they involve fraudulent projects and scams.

Malware and Ransomware Attacks

Malware and ransomware attacks are increasingly common in the cryptocurrency industry. Hackers use malicious software to gain unauthorized access to victim’s computers and steal cryptocurrency wallets.

How to Avoid Cryptocurrency Scams

We can avoid most of the cryptocurrency scams by applying following cares;

Do Your Research

Before investing in any cryptocurrency project, take the time to research it thoroughly. Check the background of the team members, read the whitepaper, and look for reviews from other investors. Avoid investing in projects with no clear roadmap or project goals.

Keep Your Private Keys Safe

Your private keys are your gateway to your cryptocurrency wallet, and they should be kept safe. Always use strong passwords and two-factor authentication to protect your wallet. Do not share your private keys with anyone.

Be Careful with Public Wi-Fi

Avoid using public Wi-Fi when accessing your cryptocurrency wallet or making transactions. Hackers can easily intercept data on public Wi-Fi networks and steal your sensitive information.

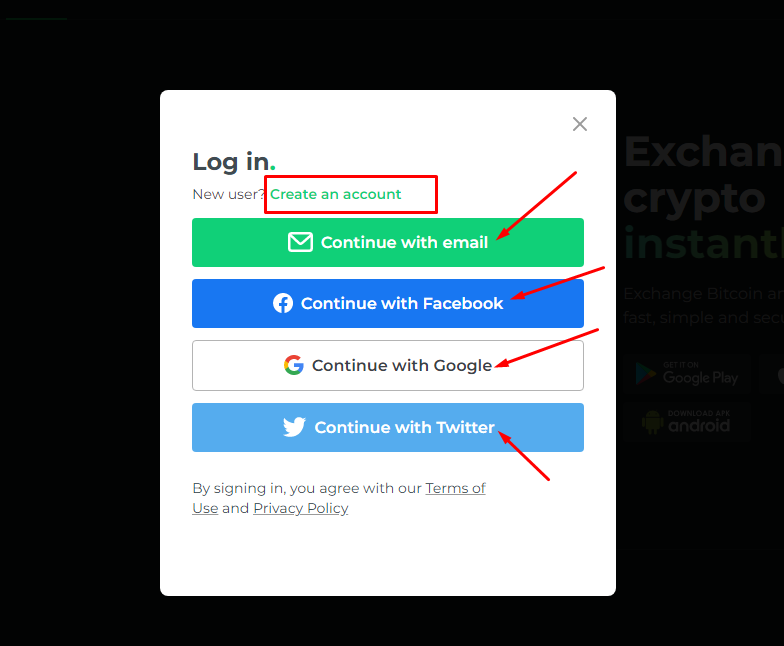

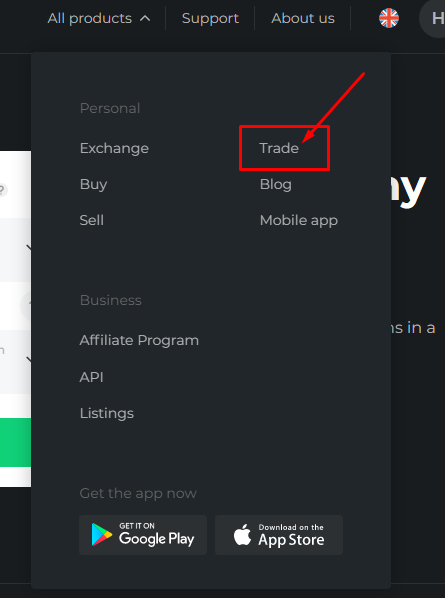

Use Trusted Exchanges

Only use trusted cryptocurrency exchanges when buying or selling cryptocurrency. Research exchanges before using them, and choose those with a good reputation and strong security measures.

FAQs

Q: Can I recover my cryptocurrency if I fall victim to a scam?

A: In most cases, it is difficult to recover stolen cryptocurrency. It’s important to take steps to avoid scams in the first place.

Q: How can I tell if an ICO is legitimate?

A: Legitimate ICOs have a clear roadmap, project goals, and a team with a proven track record. Do your research before investing.

Q: What should I do if I think I’ve fallen victim to a cryptocurrency scam?

A: If you suspect that you have been scammed, report the incident to the relevant authorities immediately. Contact your bank, the police, and the cryptocurrency exchange where you made the transaction.

Conclusion

Cryptocurrency scams can be devastating, but they can be avoided with careful research and precautionary measures. Always do your research, keep your private keys safe, avoid public Wi-Fi, and use trusted exchanges to keep your investment safe. Remember that the cryptocurrency industry is still evolving, and fraudulent activities are always a risk. Be vigilant and cautious to avoid falling victim to scams.